What happens if you pass away without a Will in Australia?

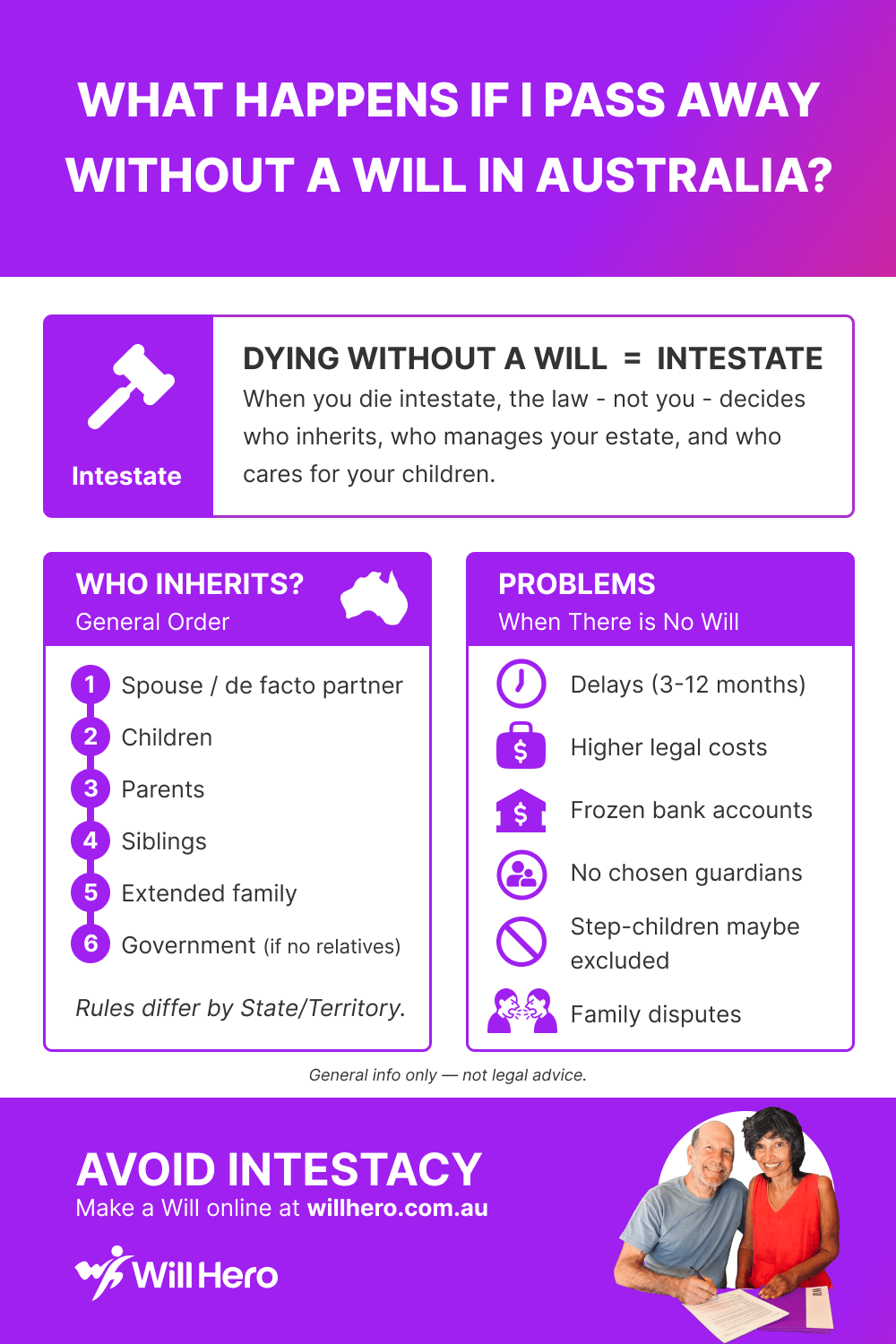

If you pass away without a Will, you die intestate. That means the law — not you — decides who inherits your estate, who manages it, and even who cares for your children. (Learn more from MoneySmart — Australian Government financial guidance). Creating a Will with backup beneficiaries and contingency layers helps ensure your estate never falls into intestacy, even if your primary beneficiaries can’t inherit.

While it might seem like everything would simply “go to your family,” intestacy laws in Australia don’t always reflect modern relationships, blended families, or your personal wishes. Understanding what happens when dying without a Will in Australia is crucial for protecting your loved ones. The stress of waiting months for access to funds, the uncertainty of court-appointed administrators, and the heartbreak of assets being divided in ways you never intended — these are real consequences your family may face. Here’s what really happens if you die without a Will — and how you can make sure your loved ones are protected.

What Does “Dying Intestate” Mean?

When someone dies without a valid Will, their estate is distributed according to the intestacy laws of their State or Territory. Each jurisdiction has its own rules — but in every case, your personal wishes have no legal effect.

Even informal notes, conversations, or messages about what you “would have wanted” usually don’t count.

If there’s no Will, no one has automatic authority to manage your estate. Your bank accounts will be frozen, property transfers can be delayed, and a court must appoint someone (called an administrator) to handle the process.

Want the details on the court process? Jump to Letters of Administration.

Who Inherits Your Estate Without a Will

Each State and Territory follows a statutory order to decide who receives your estate. While the general hierarchy is similar, the exact distribution percentages, statutory legacy amounts, and formulas differ significantly by state. For example, in NSW, a spouse may receive a statutory legacy of around $506,000 before sharing the remainder with children, while other states use different amounts and calculations. The general order is:

- Spouse or de facto partner

- Children (biological or adopted)

- Parents

- Siblings

- Extended relatives — nieces, nephews, grandparents, cousins

- The State or Territory government (if no relatives are found)

If you have a spouse and children from a previous relationship, your estate may be divided between them — sometimes equally, sometimes not. This can cause delays, disputes, and financial stress for your family.

Blended family situations can be particularly complicated under intestacy laws. Step-children who haven’t been legally adopted typically aren’t included in the statutory order of distribution, which can lead to unexpected outcomes and family conflict. Each Australian state has different rules about how blended family assets are divided — the exact percentages and statutory legacy amounts vary significantly by state. For example, in New South Wales, a surviving spouse may receive a statutory legacy of around $506,000 before sharing the remainder with children, while Victoria uses different amounts and formulas. The division in many cases may not reflect what you would have chosen, making a Will essential for blended families. Note: Eligible dependants (including step-children, de facto partners who don’t meet the time requirements, or others with a claim) can still make a claim under family provision laws in each state, even under intestacy.

Learn more: Does a spouse automatically inherit everything in Australia?

Who inherits if there’s no Will in Australia — quick reference infographic.

What Happens to Your Children

If you have young children and both parents pass away without naming a legal guardian, the Supreme Court (or relevant court in your state) decides who will care for them.

This process can take time, and family members may not agree on what’s best. Imagine the emotional toll on your children as family members dispute who should care for them, or the distress of a child being placed with someone you wouldn’t have chosen. The uncertainty and disruption during an already difficult time can have lasting effects. The person who ends up with guardianship might not be who you would have chosen, and there may be little recourse for your children.

By making a Will, you can legally appoint guardians and outline your wishes clearly — removing doubt and conflict at the worst possible time.

What Happens to Your Property, Bank Accounts, and Superannuation

Without a Will, your property, vehicles, and personal possessions will be distributed under intestacy laws — often requiring assets to be sold so the value can be divided.

Important: Before any distribution occurs, your estate must first pay all debts, funeral expenses, and legal costs. Only what remains after these payments is distributed according to the intestacy rules.

- Bank accounts are frozen until an administrator is appointed by the Supreme Court.

- Property held in your sole name becomes part of your estate and is distributed according to the statutory order after debts are paid.

- Joint property (such as with a spouse, held as joint tenants) typically passes directly to the surviving joint owner by right of survivorship and is not subject to intestacy laws.

Superannuation and life insurance are treated differently. Unlike other assets, superannuation doesn’t automatically form part of your estate. If you have a binding death benefit nomination with your super fund, it will be paid according to that nomination (either to your estate or directly to your nominated beneficiaries). Without a binding nomination, your super fund trustee decides where the money goes — which may or may not align with your wishes. Life insurance policies with named beneficiaries are also paid directly to those beneficiaries, bypassing your estate entirely.

Learn more: What happens to your superannuation after you die

Who Manages Everything (Administrator vs. Executor)

If you have a Will, your chosen Executor handles your estate according to your instructions.

Without a Will, there’s no Executor — so someone must apply to the Supreme Court for Letters of Administration. This person (called an administrator) may be a family member, but not always the person you’d have chosen.

The Letters of Administration process: Generally, the person with the highest priority under intestacy laws (usually your spouse or eldest adult child) must apply to the Supreme Court. The application typically requires sworn affidavits, death certificates, and detailed information about your assets and debts. This process typically takes 3-6 months or longer, depending on your state, court workload, and estate complexity — during which time your family cannot access bank accounts or sell property. Legal fees for obtaining Letters of Administration typically range from approximately $2,000 to $5,000 or more, varying significantly by state and estate complexity. These costs are deducted from your estate before your family receives anything, reducing what they inherit.

Creating a Will together with your partner avoids this uncertainty and ensures you both protect each other — learn how to have this important conversation. Avoid these delays and costs entirely by creating a Will today — discover the easiest way to get a Will online in Australia in just 15 minutes.

State-by-State Differences

Each Australian jurisdiction applies its own intestacy rules under separate legislation:

Intestacy Distribution by State

The table below shows how estates are typically distributed when someone dies without a Will. Important: Statutory legacy amounts are approximate as of 2026 and may be adjusted for inflation. Exact amounts, formulas, and percentages vary by state — always consult your state’s legislation or a lawyer for current figures.

| State/Territory | Spouse Only (No Children) | Spouse + Children (All Are Spouse’s Children) | Spouse + Children (Some From Previous Relationship) | Children Only (No Spouse) |

|---|---|---|---|---|

| NSW | Entire estate | Entire estate | Spouse: ~$506,000 statutory legacy + 50% of remainder Children: 50% of remainder | Equal shares |

| VIC | Entire estate | Entire estate | Spouse: ~$486,870 statutory legacy + interest + 50% of remainder Children: 50% of remainder | Equal shares |

| QLD | Entire estate | Entire estate | Spouse: ~$469,000 statutory legacy + household chattels + 50% of remainder Children: 50% of remainder | Equal shares |

| WA | Entire estate (if no children, parents, or siblings) | Entire estate | Spouse: ~$75,000 + household chattels + 50% of remainder (applies only if deceased leaves children or parents) Children: 50% of remainder | Equal shares |

| SA | Entire estate | Entire estate | Spouse: Statutory legacy (varies) + 50% of remainder Children: 50% of remainder | Equal shares |

| TAS | Entire estate (if no parents) | Entire estate | Spouse: Personal effects + statutory legacy + 50% of remainder Children: 50% of remainder | Equal shares |

| ACT | Entire estate | Entire estate | Spouse: Statutory legacy + 50% of remainder Children: 50% of remainder | Equal shares |

| NT | Entire estate (if no parents/siblings) | Entire estate | Spouse: Statutory legacy + 50% of remainder Children: 50% of remainder | Equal shares |

Note: Last verified in January 2026, this table shows common scenarios only. Additional rules apply for other situations (e.g., parents, siblings, extended relatives). De facto partners are generally treated the same as spouses if they meet state-specific criteria (typically 2-3 years cohabitation or having a child together).

Learn more: For comprehensive information about intestacy from an authoritative source, see MoneySmart’s guide on intestacy (Australian Government financial guidance).

Legislation:

- New South Wales: Succession Act 2006 (NSW)

- Victoria: Administration and Probate Act 1958 (VIC)

- Queensland: Succession Act 1981 (QLD) — Part 3: Distribution on Intestacy

- Western Australia: Administration Act 1903 (WA) — Note: Reforms to the Administration Act 1903 took effect in 2022, changing spouse/children distribution rules. The table above reflects post-2022 provisions.

- South Australia: Succession Act 2023 (SA) — in force from July 2024

- Tasmania: Intestacy Act 2010 (TAS)

- Australian Capital Territory: Administration and Probate Act 1929 (ACT)

- Northern Territory: Administration and Probate Act 1969 (NT)

Learn More: How to make a Will in Australia

Or explore our specific State guides:

Common Problems When There’s No Will

When someone dies intestate, families often face unnecessary stress and cost. Common issues include:

- Disputes between partners, children, or ex-spouses over who should inherit what

- Significant delays in releasing funds — bank accounts frozen for months while Letters of Administration are processed

- Legal costs for court applications — typically $2,000-$5,000 or more, reducing what your family receives

- Family homes being sold to divide value — a surviving spouse may be forced to sell the family home to divide assets with children

- Personal possessions and sentimental items sold to divide value — family heirlooms, jewelry, or treasured items may be liquidated rather than passed to specific loved ones

- No nominated guardians for children or pets — the court decides who cares for your children, which may not be your choice

- The wrong people inheriting — or no one at all — assets may go to distant relatives or the government instead of your chosen beneficiaries

In the absence of a Will, the Public Trustee (or similar state entity) may step in to administer the estate if no family member applies or if appointed by the court. Their fees vary significantly by state — some charge a percentage of the estate (often 3-5%), while others charge a minimum fee (often $2,000-$5,000 or higher), and fee structures differ across jurisdictions. These fees are deducted from what your family would have received before distribution. A Will that names a trusted executor can avoid these costs.

Don’t Leave Your Family to Face This

You’ve seen the delays, disputes, and stress that come with dying without a Will. A legally valid Will puts you in control — and it only takes about 15 minutes. Create yours with Will Hero: state-specific, lawyer-approved, and affordable.

Why You Shouldn’t Put Off Writing Your Will

Many Australians assume they don’t need a Will yet — but life can change quickly. Health events, property purchases, new relationships, children, or planning to travel overseas all make having a Will essential.

Read more: Why you shouldn’t put off writing your Will

This uncertainty creates real problems for families — but the good news is, you have control. You can protect your loved ones from these complications right now.

With Will Hero, you can create a legally valid, state-specific Will in minutes — and update it anytime as your circumstances change.

How to Prevent Intestacy

Avoiding intestacy is simple: create a valid Will that clearly sets out your wishes.

With Will Hero, you can:

- Create your Will online in under 20 minutes

- Automatically follow your State’s legal requirements

- Appoint Executors and Guardians

- Add detailed gifts, provisions, and backup plans

- Review your Will visually before finalising it

- Choose digital or printed delivery

You can even start at home — it’s easy and affordable.

Step-by-step Guide: How to make your Will at home

Where Should You Keep Your Will?

After signing, it’s important to store your Will safely — where your Executors can find it when needed.

Never keep your only copy in a place others can’t access (like a personal safe without sharing the code).

Read next: Where is the safest place to store your Will?

Key Takeaways

- Dying without a Will means the law decides — not you.

- Family disputes, court delays, and unexpected outcomes are common.

- Each Australian State and Territory has different intestacy laws.

- You can protect your family and your wishes by making a Will now.

Will Hero makes it simple to create a legally valid Will from home — with visual previews, guided steps, and state-specific compliance built in.

Frequently Asked Questions

Not necessarily. It depends on your State and whether you have children from other relationships. Your spouse may share your estate with your children.

De facto partners are recognised under intestacy laws in all Australian states and territories, but you must generally have lived together for at least 2 years (3 years in South Australia) immediately before death, or have had a child together. Proving the relationship can delay the process and may require documentation. A Will removes any doubt and ensures your partner is protected.

Yes. Most Australian banks will pay funeral expenses directly from the deceased's account, even if there's no Will. You'll usually need to provide a certified copy of the death certificate and a funeral tax invoice, which the bank pays directly to the funeral home. All other funds, however, remain frozen until an administrator is appointed by the Supreme Court.

Intestacy can take 6-12 months or longer to complete, while probate with a Will typically takes 3-6 months. The longer timeframe increases legal costs and delays when your family can access funds. During intestacy, bank accounts may remain frozen for months while Letters of Administration are processed, creating significant financial hardship for your loved ones.

No, step-children who haven't been legally adopted are generally not included in the statutory order of distribution under intestacy laws across Australia. Only biological children and legally adopted children are included in the intestacy hierarchy. However, step-children may be eligible to make a family provision claim (also known as a testator's family maintenance claim) in some states if they can demonstrate financial dependence or that the deceased had a moral obligation to provide for them. The eligibility criteria and process for such claims vary by state. To ensure step-children are provided for, you should create a Will that explicitly names them as beneficiaries.

No. Joint property typically passes directly to the surviving joint owner by right of survivorship, regardless of intestacy laws. This applies to joint bank accounts, joint property ownership (as joint tenants), and similar jointly held assets across all Australian states and territories. Only property held in your sole name becomes part of your intestate estate and is distributed according to the statutory order. However, if property is held as tenants in common (rather than joint tenants), your share does form part of your estate and will be distributed under intestacy laws.

Superannuation is treated differently from other assets under intestacy laws. Unlike bank accounts or property, superannuation doesn't automatically form part of your estate when you die. If you have a binding death benefit nomination with your super fund, it will be paid according to that nomination (either directly to your nominated beneficiaries or to your estate). Without a binding nomination, your super fund trustee decides where the money goes based on their fund's rules and applicable law — which may or may not align with how your estate would be distributed under intestacy laws. This is consistent across all Australian states and territories.

If no eligible relatives can be found, your entire estate may pass to the State or Territory government.

Yes — this is called bona vacantia. It's rare, but it happens when no next of kin are identified.

Create a legally valid Will today. It's fast, affordable, and gives you total control over what happens to your estate.

How Will Hero Can Help

Protecting your loved ones with a legally valid Will doesn’t have to be complicated or expensive. Will Hero makes the process straightforward with:

- Step-by-Step Visual Guidance: An intuitive interface guides you through every section, helping you understand how your estate will be distributed. Visual previews show exactly how your assets will be allocated to your beneficiaries.

- More than just a Simple Will: Customize your Will with detailed provisions and clauses to match your unique circumstances. Whether your estate is straightforward or more complex, you can tailor your Will to your exact needs.

- AI Assistant: Will Hero’s AI Assistant WillBot is available around the clock to help with questions about Wills, estate planning, and Australian law.

- Expert Support: Get assistance whenever you need help with witnessing, signing procedures, or safe storage of your Will. Discover the safest places to store your will and expert tips for protecting your important documents.

- Easy Updates: Update your Will whenever your situation changes—new relationships, children, property acquisitions, or other life events. Make unlimited changes to your Will throughout your 12-month subscription period.

- Cost-Effective: Will Hero offers professional-quality Will creation at a fraction of traditional lawyer fees.

Will Hero helps you create a Will that meets your state’s legal requirements without the high costs or scheduling constraints of traditional legal services. For particularly complex estates, you can use Will Hero to get started, then consult a lawyer for additional advice if needed.

Ready To Protect Your Loved Ones?

The Solution: Create a Valid Will

The best way to avoid the complexities of intestacy is to create a legally valid Will that clearly expresses your wishes. While intestacy rules provide a default distribution, they may not match your preferences—especially if you have specific beneficiaries, charitable intentions, or complex family structures.

Create your Will online in Australia with state-compliant templates, professional review, and clear guidance through every step. See pricing to get started. This ensures your estate is distributed exactly as you intend, avoiding the delays, disputes, and uncertainty that come with dying without a Will.