Introduction

Leaving a gift to charity in your Will is one of the most powerful ways to support the causes that shaped your life. It’s a meaningful, thoughtful act that allows you to create a legacy—without affecting your current financial situation.

More Australians are making charitable gifts in their Wills every year. Some leave a modest fixed amount, while others choose to give a percentage of their estate. Charitable bequests help fund medical research, animal welfare, environmental protection, community services, and countless other causes.

This guide explains why people choose to leave money to charity, the different types of gifts, how to do it correctly under Australian rules, and how Will Hero makes the entire process easier, more accurate, and more flexible. You’ll learn how to choose the right charity, understand the legal requirements, avoid common mistakes, and ensure your charitable gift is properly documented in your Will. For a comprehensive guide to all common Will mistakes (not just charity-related), see our detailed article: Common Mistakes People Make When Making a Will (And How to Avoid Them).

Why Leave Money to a Charity in Your Will?

1. Support the causes that shaped your life

Your Will gives you the opportunity to reflect your values—whether that’s medical research, animal welfare, the environment, education, or community support.

2. Make a difference without affecting your finances today

A charitable gift takes effect only after you pass away, so you retain full control of your assets throughout your lifetime.

3. Create a lasting legacy

Even a modest amount can have a significant impact. Many charities depend on Gifts in Wills for future sustainability.

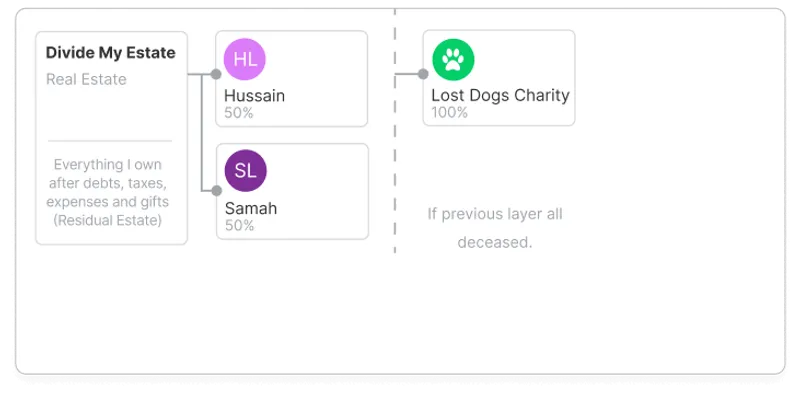

4. Provide a meaningful backup

Some people name a charity as a secondary or final backup beneficiary. If your primary beneficiaries pass away before you, a charity can receive your estate instead of defaulting to government intestacy rules.

5. Potential tax efficiencies

Many charities are tax-exempt and can receive gifts without paying tax. In some cases, the estate may also receive tax benefits when donating certain assets (for example, shares), though tax rules can be complex and the estate may still have other tax obligations.

(General information only—seek financial advice for your circumstances.)

Mini Case Studies

Joey (WA)

Joey is leaving a specific gift of $10,000 to Kids Helpline in his Will. He chose a fixed amount because he wants to ensure the charity receives this exact sum, and Kids Helpline’s youth mental health support programs have special meaning to him.

Emily (NSW)

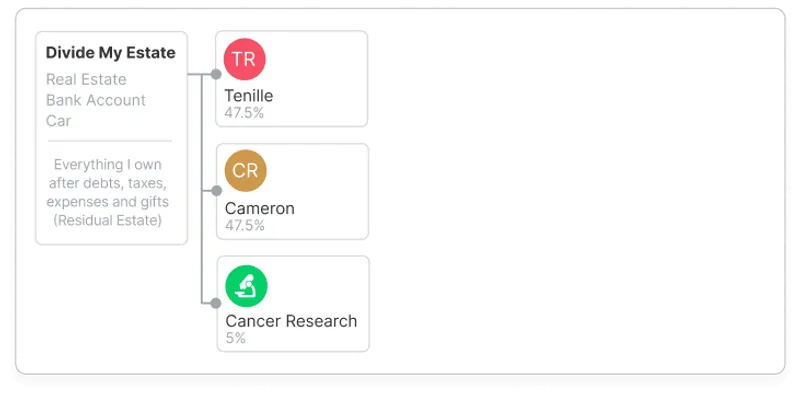

Emily left 5% of her residual estate to a cancer research organisation. Her main beneficiaries are her children, but she wanted part of her legacy to support medical breakthroughs.

Ahmed (VIC)

Ahmed named an animal rescue charity as a backup beneficiary. If his primary beneficiaries pass away before him, his estate will support a cause he loves rather than be distributed by default rules.

Types of Gifts You Can Leave to a Charity

In Australia, there are two primary categories of charitable gifts.

1. Specific Gifts

A specific gift is a clearly defined item or amount.

Examples include:

- A fixed dollar amount (e.g., “$5,000 to Beyond Blue”)

- A specific asset (e.g., a vehicle, artwork, jewellery)

- A percentage of a specific item (e.g., “20% of my share portfolio in XYZ”)

These are precise and helpful for preventing confusion.

Note: If you leave a specific asset (like property, artwork, or a vehicle), your executor may decide to sell the asset and give the charity the cash proceeds if the charity prefers cash or if selling is more practical than transferring the physical asset.

Note on terminology

A “percentage of a specific asset” is still technically a specific gift—it is not a residual gift. Residual gifts always relate to the remainder of the estate as a whole.

2. Residual Estate Gifts (Percentage of Residue)

Your residual estate is what remains after:

- debts and taxes

- funeral expenses

- executor costs

- all specific gifts

Note: Specific charitable gifts (like a fixed dollar amount or specific asset) are paid before the residual estate is calculated. This means they come out first, before percentages of the remainder are worked out. This is why many people prefer residual percentage gifts, as they ensure your loved ones receive their share after all specific gifts have been distributed.

A residual gift is always expressed as a percentage, for example:

“10% of my residual estate to the Royal Flying Doctor Service.”

Residual gifts are popular because:

- they adjust automatically with the size of your estate

- they protect primary beneficiaries

- they are not eroded by inflation over time

How to Leave Money to a Charity in a Traditional Will

If you’re using a solicitor, Will kit, or another online Will service, follow these steps to ensure the gift works exactly as you intend.

1. Identify the correct legal name

Charities often use trading names or change names over time.

To avoid misdirection, include:

- full legal name

- ABN

- registered address (optional but recommended)

Incorrect naming can delay or prevent a charity from receiving its gift.

2. Make sure the organisation is eligible

Most people choose charities registered with the ACNC (Australian Charities and Not-for-profits Commission).

If unsure, check the ACNC public register.

3. Choose the type of gift

Your options include:

- specific gift (amount, object, or percentage of an asset)

- percentage of residual estate

- conditional/backup charitable gifts

4. Use clear, unambiguous wording

Avoid vague descriptions such as:

- “the heart foundation charity”

- “the cancer charity in Australia”

Clear instructions reduce delays and disputes.

5. Let the charity know (strongly recommended)

It’s not legally required, but charities genuinely appreciate it.

Why?

- They can plan future funding

- They can confirm that your legal wording correctly identifies them

- They can guide you if they have multiple foundations, branches, or funds

- They can acknowledge your intention privately, publicly, or anonymously

- It reduces the risk of confusion if the charity later merges or restructures

Important reminder: Your charitable gift only becomes legally effective if your Will is correctly signed and witnessed according to your state’s rules. Each Australian state and territory has specific requirements for Will signing and witnessing, so make sure you follow the correct procedures for your jurisdiction. Learn more about making a legally valid Will in Australia.

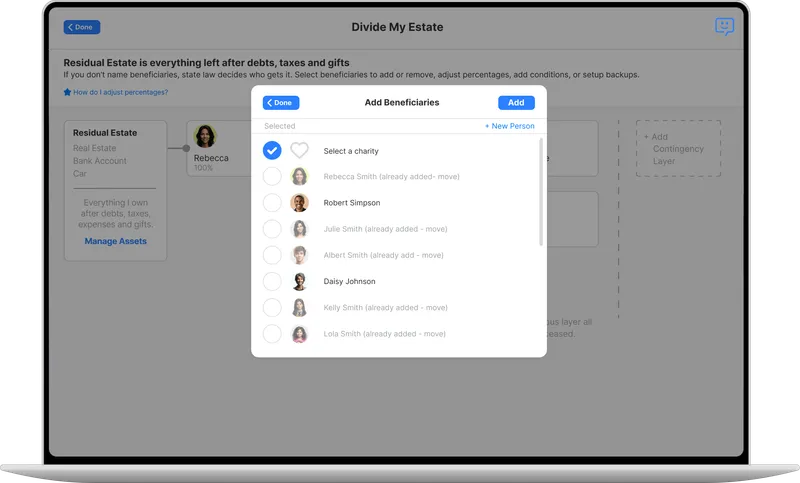

How to Leave Money to Charity Using Will Hero

Will Hero removes the complexity and ensures your charitable gift is legally accurate. Learn more about creating your Will online with Will Hero.

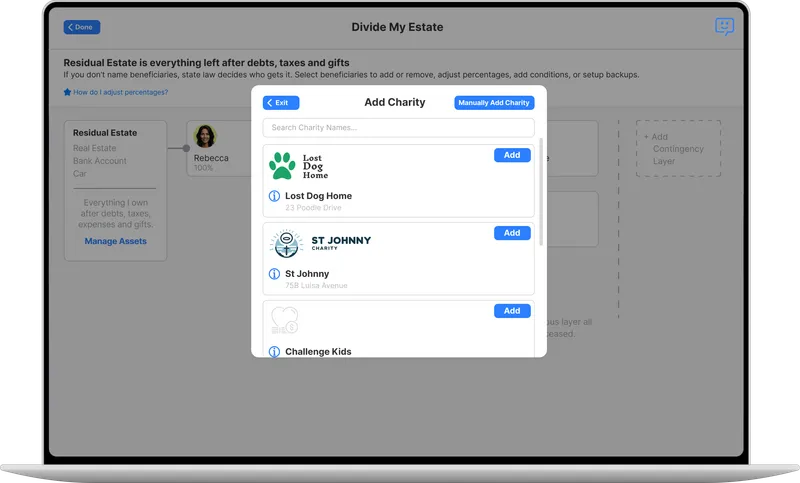

1. Search all registered Australian charities

Will Hero provides access to approximately 60,000 registered Australian charities, with new charities updated weekly. Our visual Will interface makes it easy to see your entire estate plan, including charitable gifts.

You can:

- type the name

- filter by cause

- instantly select the correct entity

- never worry about incorrect naming or ABN errors

2. Add any organisation

You can include:

- small local community groups

- international charities

- foundations

- any other organisation you want to support

3. Choose the exact type of gift

Will Hero supports:

- specific dollar amounts

- specific objects

- percentage of specific assets

- percentage of residual estate

- multi-layer backup charitable gifts

You can add multiple layers of contingency (something most platforms don’t allow).

4. Will Hero writes the precise legal wording automatically

Your Will includes the correct:

- name

- ABN

- gift type

- contingency rules

This ensures your charity receives the gift exactly as intended.

5. Ideal for charities

For charities reading this:

- Will Hero reduces misdirected gifts caused by naming errors

- Supporters can leave gifts effortlessly

- Residual and conditional gifts are supported

- You’ll receive more fully documented, accurate bequests

We’ll also be providing guidance and materials to help your supporters use Will Hero for Gifts in Wills.

Ready to Leave a Gift to Charity?

Create your Will with Will Hero and easily add charitable bequests with our built-in charity search. Get started for just $99 with free updates for 12 months.

Making your Will online?

If you’re creating your Will online, explore our complete guide to online Will creation in Australia to learn about digital Will platforms, legal requirements, and how to ensure your online Will is legally valid. Will Hero’s platform includes powerful features like Visual Will to see your estate plan visually, Scenario Testing to test your Will under different circumstances, and AI assistance to help answer your questions throughout the process.

Tips for Leaving Money to Charity

- Discuss your intentions with family to avoid misunderstandings

- Review your Will when life circumstances change or if the charity merges or changes its name

- Consider inflation when leaving fixed dollar amounts—residual percentage gifts automatically adjust with your estate’s value

- Check if the charity has a dedicated Gifts-in-Wills team who can help answer questions

- Keep a clear record of your digital assets and account details

- Tell the charity about your gift (very important) so they can plan and confirm your wording is correct

- Store your Will safely and ensure your executor knows where to find it. Read our guide on where to store your Will for best practices

Common Mistakes to Avoid

When leaving money to charity in your Will, avoid these common pitfalls:

For a comprehensive guide to all common Will mistakes (not just charity-related), see our detailed article: Common Mistakes People Make When Making a Will (And How to Avoid Them).

- Using incorrect or vague charity names — Always use the charity’s full legal name and ABN to prevent delays or misdirection

- Forgetting to update your Will — If a charity merges, changes its name, or closes, update your Will to reflect the change

- Leaving fixed amounts without considering inflation — A $5,000 gift today may be worth less in real terms decades from now; consider residual percentage gifts instead

- Not telling your executor — Make sure your executor knows about your charitable intentions and where to find relevant documentation

- Using informal language — Vague descriptions like “the cancer charity” can lead to disputes; be specific and use proper legal wording

How Much Should I Leave to Charity?

There’s no right or wrong amount—it’s entirely up to you. Here are some considerations to help you decide:

- Your financial situation — Only leave what you can comfortably afford after providing for your loved ones

- The impact you want to make — Even small amounts can make a significant difference to charities

- Fixed vs. percentage — Fixed amounts give certainty, while percentage gifts adjust with your estate’s value

- Multiple charities — You can split your gift among several organisations if you support multiple causes

- Backup planning — Consider naming charities as backup beneficiaries if your primary beneficiaries can’t inherit

Remember: There’s no minimum amount required. Many people leave modest gifts that still have a huge impact on the charities they support.

Checklist: Leaving Money to a Charity in Your Will

Before drafting your Will:

- Choose your charity

- Confirm the legal name and ABN

- Decide the type of gift (specific or residual)

- Consider a backup charity

- Consider telling the charity

When drafting your Will:

- Use clear legal wording

- Include ABN

- Confirm asset descriptions (if leaving objects or shares)

- If using an online Will platform, ensure it supports charitable bequests

- Ensure your Will is correctly signed and witnessed according to your state’s requirements

After signing your Will:

- Store it safely

- Inform your executor

- Review it every few years

- Update it if the charity changes, closes, or merges

Frequently Asked Questions

No. Many people leave modest gifts that still have a huge impact. Even a small percentage of your estate or a specific amount can make a meaningful difference to a charity's programs and long-term sustainability.

Related Articles & Resources

You Might Also Like

Explore our comprehensive guides and resources to help you create a complete Will that protects your loved ones and supports the causes you care about.

How to Make a Legally Valid Will in Australia

Complete step-by-step guide covering executors, beneficiaries, guardians, and all essential Will sections.

Read guide →Why Do I Need Backup Beneficiaries in My Will?

Learn why backup beneficiaries are essential for protecting your estate, including using charities as backup beneficiaries.

Read guide →How It Works

See how Will Hero’s visual interface makes it easy to create your Will, search for charities, and leave a meaningful legacy.

Learn more →The Easiest Way to Get a Will Online in Australia

Discover how online Will platforms make it simple to create a legally valid Will from home, including how to leave gifts to charity.

Read guide →How to Make Your Will at Home

Learn how to create your Will at home using online platforms, including tips for leaving charitable gifts and ensuring legal validity.

Read guide →