Dying Without a Will in Queensland: What Happens to Your Estate?

Dying without a Will in Queensland means the Succession Act 1981 (QLD) takes control of your estate. Your Brisbane home, Gold Coast property, investments, bank accounts, and personal possessions are distributed according to Queensland’s strict intestacy rules — regardless of what you wanted or discussed with family. Learn more: Online Wills Queensland

For Queenslanders from Brisbane to the Gold Coast, Cairns to Townsville, dying intestate creates real problems: most bank accounts in the deceased’s sole name frozen for months, costly Queensland Supreme Court applications, family conflicts over inheritance, and assets split in ways you’d never choose.

This guide explains exactly how Queensland intestacy works, who inherits what, and how creating a Will protects your estate from these outcomes.

Jump to Section

Understanding Queensland Intestacy Laws

In Queensland, dying intestate triggers Part 3 of the Succession Act 1981 (QLD) — a set of statutory rules that override your personal wishes completely. Like other states, Queensland uses specific distribution formulas, statutory legacy amounts, and court procedures that apply uniformly across the state. While Queensland intestacy rules (also known as QLD intestacy rules) follow the Succession Act 1981 (QLD), the basic principle is similar across Australia — learn more in our complete Australia-wide guide to dying without a Will.

The harsh reality: Conversations with family, handwritten notes, or informal documents not intended as a Will have no legal effect under Queensland law. Only a valid Will (including a court-accepted informal Will under section 10 of the Succession Act 1981 (QLD)) can override intestacy rules.

Without a Will, your estate has no automatic executor. Family members must apply to the Queensland Supreme Court for Letters of Administration — a legal process that freezes most bank accounts held solely in the deceased’s name and blocks property transfers. Understanding QLD Will laws and Queensland intestacy rules helps you see why creating a Will is essential. Processing times are unpredictable but typically range from 4-6 months in Brisbane (often longer in regional areas like Cairns or Townsville), and can extend significantly if disputes arise or the estate is complex. During this entire period, your loved ones have no access to funds, even for urgent expenses.

Want the details on the court process? Jump to Letters of Administration.

Who Inherits if You Die Without a Will in Queensland?

Under the Succession Act 1981 (QLD) (also known as Succession Act QLD Part 3), Queensland follows a strict statutory order to decide who receives your estate. Queensland inheritance laws (also referred to as QLD inheritance laws) determine the exact distribution depending on which relatives survive you:

Queensland Intestacy Distribution Order

- Spouse or de facto partner

- Children (biological or adopted)

- Parents

- Siblings

- Extended relatives — nieces, nephews, grandparents, cousins

- The Queensland government (if no relatives are found)

How Your Estate Is Distributed in Queensland

Spouse Only (No Children)

If you die without a Will in Queensland and are survived by a spouse or de facto partner but no children, your spouse inherits the entire estate.

Example: Sarah lives in Brisbane and dies without a Will. Her husband David inherits her entire estate — her Brisbane home, investments, superannuation (if not separately nominated), and all personal possessions.

Spouse and Children (All Are Spouse’s Children)

If you have a spouse and children, and all children are from that relationship, your spouse inherits the entire estate. Your children receive nothing under intestacy laws. While children may be eligible to make a family provision claim, such claims depend entirely on circumstances and are not guaranteed.

Example: Michael lives on the Gold Coast with his wife Lisa and their two children. If Michael dies without a Will, Lisa inherits everything — the Gold Coast home, all assets, and investments. In this scenario, the children do not inherit under intestacy laws. While they may have rights under family provision legislation, such claims are typically complex and outcomes depend on circumstances.

Spouse and Children (Some From Previous Relationship)

This is where Queensland intestacy laws can create unexpected outcomes for blended families. If you have a spouse and children from a previous relationship, your estate is divided as follows:

- Household chattels (furniture, personal items, vehicles) go to your spouse

- Statutory legacy: Your spouse receives approximately $469,000 (this amount is CPI-indexed quarterly, meaning it changes every three months based on inflation)

- Remainder: The remaining estate is split 50/50:

- 50% to your spouse

- 50% divided equally among all your children

Queensland Example: John lives in Brisbane with his second wife Emma. He has two children from his first marriage living in Townsville. John dies without a Will with an estate worth $800,000.

- Emma receives: Household chattels + $469,000 + 50% of remainder ($165,500) = approximately $634,500 plus chattels

- Children (combined): 50% of remainder ($165,500) = approximately $82,750 each

This division may not reflect what John would have chosen — Emma receives most of the estate, while his children receive significantly less.

Learn more: Does a spouse automatically inherit everything in Australia?

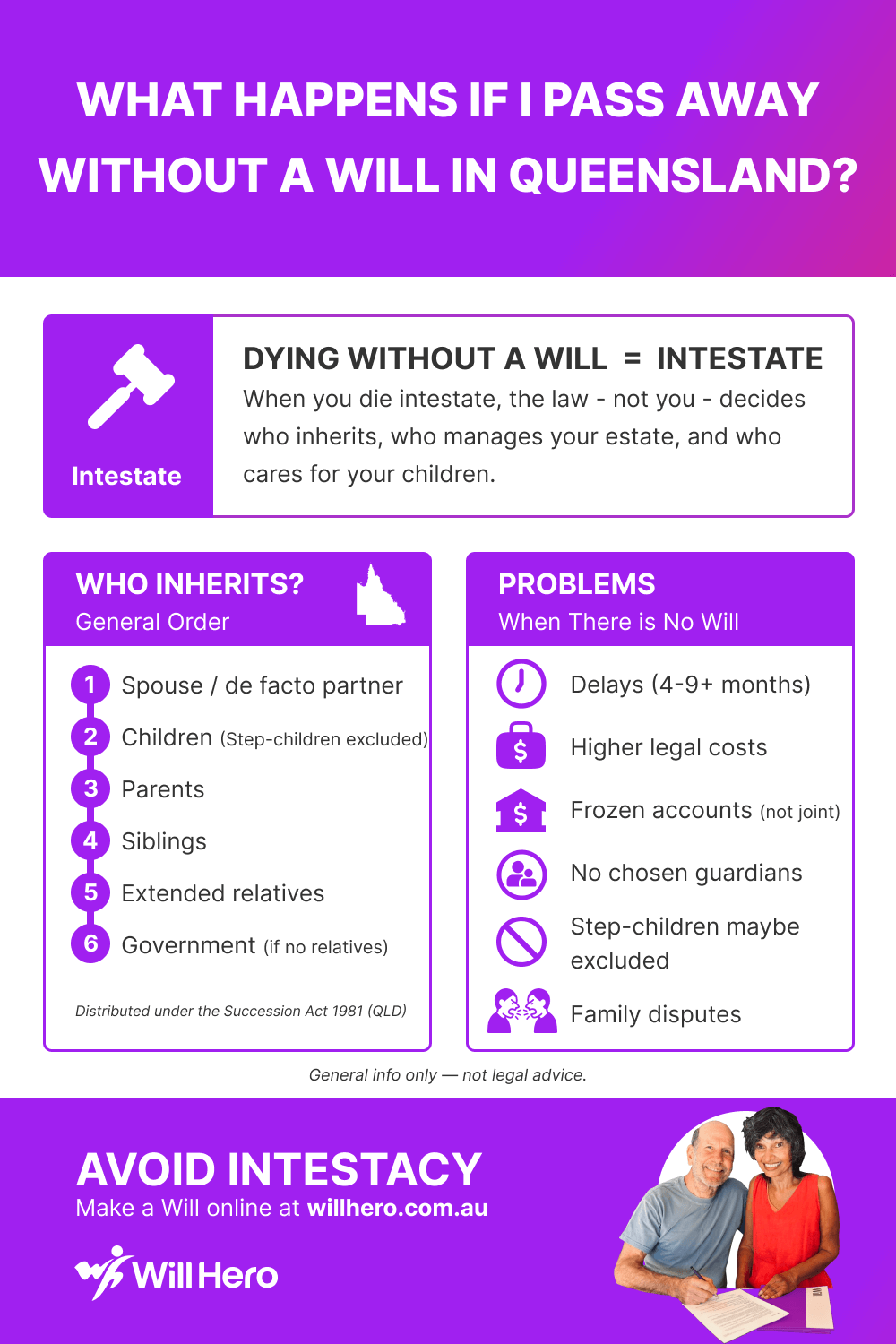

Who inherits if there’s no Will in Queensland — quick reference infographic.

Children Only (No Spouse)

If you die without a Will in Queensland and have children but no spouse, your children inherit the estate in equal shares.

Example: David lives in Cairns and dies without a Will. He has three adult children. Each child receives one-third of his estate equally.

Parents, Siblings, and Extended Family

If you die without a Will in Queensland and have no spouse or children, your estate passes to:

- Parents (equally if both survive)

- If no parents: Siblings (equal shares)

- If no siblings: Extended relatives (nieces, nephews, grandparents, cousins)

- If no relatives found: The Queensland government (bona vacantia)

De Facto Partners in Queensland

De facto partners are recognised under Queensland intestacy laws, but only if specific requirements are met under the Succession Act 1981 (QLD):

- 2-year requirement: You must have lived together continuously for at least 2 years immediately before death, OR

- Child together: You have had a child together (regardless of cohabitation period)

Queensland Example: Amanda and Tom live together in Brisbane for 18 months. Amanda dies without a Will. Under Queensland law, Tom does not qualify as a de facto partner because they haven’t lived together for the required 2 years. Amanda’s estate would pass to her children or parents instead.

Important: Proving a de facto relationship can be complex and may require documentation (joint bank accounts, shared bills, evidence of cohabitation). This process can delay estate administration significantly. A Will removes all doubt and ensures your partner is protected.

Blended Families and Step-Children in Queensland

Step-children who haven’t been legally adopted are generally not included in Queensland’s statutory order of distribution. This can create difficult situations for blended families.

Queensland Example: Rachel lives on the Gold Coast with her husband Mark. Rachel has a step-son from Mark’s previous marriage who she raised for 10 years. Rachel dies without a Will. Her step-son receives nothing under Queensland intestacy laws, even though Rachel viewed him as her own child.

Exception: Step-children may be eligible to make a family provision claim under Queensland law if they were:

- Wholly or substantially maintained by the deceased, OR

- A dependant member of the deceased’s household

However, family provision claims are expensive, time-consuming, and uncertain — outcomes are not guaranteed. Creating a Will that explicitly names step-children as beneficiaries avoids this uncertainty entirely.

How Queensland Intestacy Affects Your Assets

Bank Accounts in Queensland

Most bank accounts in the sole name of the deceased will be frozen upon death if there’s no Will. Banks have discretion in this area, but typically freeze sole-name accounts to protect the estate until Letters of Administration are granted — a process that typically takes 4-6 months in Brisbane (often longer in regional Queensland courts like Rockhampton, Mackay, or Townsville), though timelines can vary significantly depending on court workload and estate complexity.

Joint accounts: Joint accounts usually remain accessible to the surviving account holder. Joint bank accounts are generally not frozen unless the bank has specific concerns about the account or estate, though banks may restrict large withdrawals until the estate is administered.

Critical exception: Most Queensland banks will release funds directly to funeral homes for burial or cremation costs from sole-name accounts if you provide a death certificate and funeral invoice. All other funds in sole-name accounts remain inaccessible during the entire administration period.

Queensland Property Distribution

Sole ownership: Property you own individually (whether in Brisbane’s inner suburbs, Gold Coast beachfront, or regional Queensland) becomes part of the intestate estate. Property may need to be sold to allow the estate to be divided according to Queensland’s statutory formulas — meaning a family home might be sold even if your spouse and children still live there, because assets may need to be converted to cash for equal distribution, and the surviving spouse may not be entitled to receive the property outright under the intestacy formula.

Joint tenants vs tenants in common: This distinction matters critically in Queensland:

- Joint tenants: The surviving owner automatically inherits the full property (bypasses intestacy entirely)

- Tenants in common: Your share becomes part of the intestate estate and is distributed according to Queensland’s statutory order

Real Queensland scenario: A Gold Coast couple owns their beachfront home as tenants in common (50% each). One partner dies without a Will. The deceased partner’s 50% share goes through intestacy — potentially forcing a sale or requiring the surviving partner to buy out the deceased’s share from the intestacy distribution.

Superannuation and Life Insurance in Queensland

Superannuation is treated differently from other assets. It does not automatically form part of your estate. If you’ve made a binding death benefit nomination, your super fund must follow it. Without one, the fund trustee decides based on the fund’s rules — which may ignore Queensland intestacy distribution entirely.

Life insurance with named beneficiaries bypasses your estate completely, regardless of Queensland intestacy laws.

Learn more: What happens to your superannuation after you die

Children and Guardianship in Queensland

When both parents die without Wills in Queensland, a court will appoint a guardian for your children — this may be the Supreme Court, Federal Circuit and Family Court, or the Children’s Court depending on the situation. The court may choose family members you wouldn’t have selected or create disputes between relatives who both apply.

The court process for appointing guardians is governed by family law legislation (not intestacy law) and can take months, involving:

- Family members filing competing applications

- Court assessments of each applicant’s suitability

- Interviews with children (if age-appropriate)

- Potential placement in temporary care during proceedings

For Queensland children already traumatized by losing parents, this additional uncertainty and potential family conflict can cause lasting psychological harm. Creating a Queensland Will lets you appoint specific guardians and provide detailed instructions about your children’s care, education, and living arrangements.

Letters of Administration in Queensland

If you die without a Will in Queensland, there’s no Executor to manage your estate. Instead, someone must apply to the Queensland Supreme Court for Letters of Administration.

Who Can Apply?

Generally, the person with the highest priority under Queensland intestacy laws (usually your spouse or eldest adult child) must apply. The application requires:

- Sworn affidavits

- Death certificates

- Detailed information about your assets and debts

- Evidence of relationships (especially for de facto partners)

How Long Does It Take in Queensland?

Queensland Supreme Court processing times vary significantly and are unpredictable:

- Brisbane: Typically 4-6 months for straightforward estates, but can vary based on court workload

- Regional Queensland: Often 6-9 months or longer due to limited court sitting schedules, fewer court staff, and less frequent probate hearings

- Complex estates: Can extend well beyond 12 months if disputes arise, extensive asset valuations are required, or documentation is incomplete

During the entire process:

- Most bank accounts in the deceased’s sole name remain frozen (joint accounts are typically accessible)

- Property sales cannot proceed

- Beneficiaries have no access to funds from frozen accounts for living expenses, mortgage payments, or emergency costs

What Does It Cost in Queensland?

Queensland legal fees for Letters of Administration:

- Basic estates: May cost $2,500-$4,000 in Brisbane and Gold Coast

- Regional Queensland: Often higher due to travel and limited solicitor competition

- Complex estates: Can cost $5,000-$10,000+ if disputes arise or extensive asset valuations are needed

- Queensland Public Trustee: The Queensland Public Trustee may charge percentage-based fees depending on the estate and services required

These fees are deducted from the estate before any distribution occurs — meaning your family receives less.

Creating a Will together with your partner avoids this uncertainty and ensures you both protect each other — learn how to have this important conversation. Avoid these delays and costs entirely by creating a Will today — discover the easiest way to get a Will online in Australia in just 15 minutes.

How Queensland Differs from Other Australian States

Queensland’s intestacy laws have distinct features that differ significantly from other states:

Queensland vs NSW and Victoria

- Statutory legacy: Queensland uses approximately $469,000 (CPI-indexed quarterly, with household chattels) for blended families, while NSW uses ~$506,000 and Victoria ~$486,870 (each state’s amount is also adjusted for inflation)

- Distribution formula: Queensland’s 50/50 split between spouse and children (after statutory legacy) differs from other states’ percentages

- Court procedures: Queensland Supreme Court processes can differ from NSW Supreme Court or Victorian County Court procedures

Queensland-Specific Legislation

Queensland intestacy is governed by the Succession Act 1981 (QLD), specifically Part 3: Distribution on Intestacy.

Official Legislation: Succession Act 1981 (QLD) — Part 3: Distribution on Intestacy

Queensland-specific notes:

- The statutory legacy amount is CPI-indexed quarterly (adjusted every three months for inflation) — consult current legislation or a Queensland solicitor for exact figures at the time of death

- The Act has been amended multiple times since 1981 (de facto recognition, distribution changes) — always reference the current version

- Queensland courts (Brisbane vs regional) may have different processing times and requirements

Regional Queensland Considerations

Queensland’s geographic size creates unique challenges for intestacy administration:

Brisbane vs Regional Queensland Courts

- Brisbane Supreme Court: Typically processes Letters of Administration in 4-6 months for straightforward estates, though timelines are unpredictable and can vary based on court caseloads and estate complexity

- Regional courts (Rockhampton, Townsville, Cairns, Mackay): Often take 6-9 months or longer due to limited sitting schedules, fewer court staff, and less frequent probate hearings

Property in Regional Queensland

Regional Queensland properties (rural land, mining towns, coastal communities) may face:

- Longer valuations and sale processes

- Different property market conditions affecting distribution amounts

- Additional complexity if property includes business assets or farming equipment

Access to Legal Services

Families in regional Queensland may face:

- Fewer solicitors with probate experience

- Higher costs for court applications (requiring Brisbane solicitors)

- Travel expenses for court appearances

Common Problems When There’s No Will in Queensland

Queensland families face several common issues when someone dies intestate:

- Disputes between partners and children over who should inherit what

- Significant delays in releasing funds — most sole-name bank accounts frozen for months

- Legal costs that may be $2,000-$5,000+ (can be higher for complex estates) reducing what your family receives — learn why you shouldn’t put off writing your Will and how these costs can be avoided

- Family homes may need to be sold — a surviving spouse in Brisbane or Gold Coast may need to sell property to divide assets with children from a previous relationship, as assets must be converted to cash for equal distribution

- Personal possessions sold — sentimental items liquidated rather than passed to specific loved ones

- No nominated guardians for children or pets — a court will decide (this may be the Supreme Court, Federal Circuit and Family Court, or the Children’s Court depending on the situation)

- The wrong people inheriting — or no one at all (estate goes to Queensland government)

In the absence of a Will, the Queensland Public Trustee may step in to administer the estate if no family member applies or if appointed by the court. The Public Trustee charges fees that vary depending on estate size and complexity, further reducing what your family receives.

The Solution: The best way to avoid these Queensland-specific problems is to create a legally valid Will. Create your Will online in Australia with Queensland-specific templates and professional review to ensure your wishes are followed and your family is protected.

How to Avoid Intestacy in Queensland

Avoiding intestacy in Queensland is simple: create a valid Will that clearly sets out your wishes under the Succession Act 1981 (QLD). Creating a Will protects your estate and ensures your wishes are followed — create your Will online in Queensland with our state-compliant platform, discover the easiest way to get a Will online in Australia in just 15 minutes, or learn how to make a Will in Queensland for Queensland-specific requirements.

With Will Hero, you can create a Queensland-compliant Will that:

- Follows all Queensland legal requirements automatically

- Allows you to appoint Executors and Guardians

- Lets you specify exactly who inherits what

- Includes detailed gifts, provisions, and backup plans

- Gives you visual previews before finalising

- Works from home in Brisbane, Gold Coast, or anywhere in Queensland

You can even start your Will from home — it’s easy and affordable.

Step-by-step Guide: How to make your Will at home

Queensland-Specific Guides:

- How to make a Will in Queensland — Complete QLD guide with signing rules and requirements

- Online Wills Brisbane — Create your Will online in Brisbane with Will Hero

Where Should You Keep Your Will in Queensland?

After signing your Will in Queensland, it’s important to store it safely — where your Executors can find it when needed. Never keep your only copy in a place others can’t access (like a personal safe without sharing the code).

Common storage options in Queensland include:

- Secure home filing (with a trusted family member knowing the location)

- Queensland solicitor’s office

- Bank safety deposit box (major banks in Brisbane, Gold Coast, and regional areas offer these)

- Queensland Public Trustee (offers Will storage services)

Many Queensland residents choose multiple copies — one at home and one with their solicitor for added security.

Read next: Where is the safest place to store your Will?

Queensland vs. Other Australian States

Intestacy laws vary significantly across Australia. While Queensland uses a statutory legacy of approximately $469,000 (CPI-indexed quarterly) for blended families, other states use different amounts, each also adjusted for inflation:

- New South Wales: ~$506,000 statutory legacy

- Victoria: ~$486,870 statutory legacy

- Western Australia: ~$75,000 (plus household chattels and 50% of remainder)

- South Australia: Varies by formula

- Tasmania: Statutory legacy plus 50% of remainder

- ACT and NT: Different statutory legacy amounts

The distribution percentages, formulas, and statutory legacy amounts differ significantly by state. Always ensure you understand your specific state’s laws.

Learn More: What happens if you die without a Will in Australia — Complete Australia-wide guide with state-by-state comparisons

Or explore our specific State guides:

Key Takeaways

- Dying without a Will in Queensland means the Succession Act 1981 (QLD) decides — not you

- Blended families face complex distribution rules with statutory legacy amounts

- Family disputes, court delays, and unexpected outcomes are common

- De facto partners must meet the 2-year requirement or have a child together

- Letters of Administration typically take 4-6 months (though timelines are unpredictable) and may cost $2,000-$5,000+ (can be higher for complex estates)

- You can protect your Queensland family and your wishes by creating your Will online with Queensland-compliant templates

Will Hero makes it simple to create a legally valid Queensland Will from home — with visual previews, guided steps, and Queensland-specific compliance built in. Create your Queensland Will online to avoid intestacy and protect your loved ones.

Frequently Asked Questions

Under Queensland's Succession Act 1981 (QLD), your estate is distributed according to strict statutory formulas based on which relatives survive you. Your spouse or de facto partner is considered first, followed by children, parents, siblings, and extended family. The exact distribution depends on your family situation — for example, blended families face different rules than nuclear families. Without a Will, you have no control over who receives what.

Only in specific circumstances. If you have a spouse and children (all from that same relationship), your spouse inherits the entire estate. However, Queensland's rules change dramatically for blended families: if you have children from a previous relationship, your spouse receives household chattels plus approximately $469,000 statutory legacy plus 50% of the remainder, while your children from the previous relationship receive the other 50% of the remainder. This division may not reflect what you would have chosen.

Yes, but only if strict requirements are met. Queensland requires either 2 years of continuous cohabitation immediately before death, or a child together. Proving the relationship to the Queensland Supreme Court requires documentation (joint bank accounts, shared bills, statutory declarations from witnesses), which can add months to the administration process. Creating a Will eliminates this burden entirely.

Queensland's statutory legacy is approximately $469,000 (CPI-indexed quarterly, meaning adjusted every three months for inflation) plus all household chattels. This amount is paid to a surviving spouse before the remainder of the estate is divided 50/50 with children from previous relationships. This ensures the spouse receives a substantial fixed sum, but it can disadvantage children from earlier relationships — especially if the total estate is smaller than expected.

Queensland Supreme Court processing times vary significantly and are unpredictable. Brisbane courts typically take 4-6 months for straightforward estates (though this can vary based on court workload), while regional Queensland courts (Townsville, Cairns, Rockhampton) often take 6-9 months or longer due to limited sitting schedules. Complex estates or disputes can extend this well beyond 12 months. During this entire period, most bank accounts in the deceased's sole name remain frozen and property transfers are blocked. Having a valid Will with a named executor allows a simpler probate process, which typically takes just 6-8 weeks after filing.

Most bank accounts in the sole name of the deceased will be frozen by the bank upon death if there's no Will. However, banks have discretion in this area — they're not required to freeze every account. Joint bank accounts are generally not frozen unless the bank has specific concerns; the surviving joint account holder can typically continue accessing joint accounts (though banks may restrict large withdrawals). The freeze on sole-name accounts continues until Letters of Administration are granted, which typically takes 4-6 months in Brisbane (though timelines are unpredictable) and longer in regional Queensland.

No, step-children who haven't been legally adopted are generally not included in the statutory order of distribution under Queensland intestacy laws. Only biological children and legally adopted children are included. However, step-children may be eligible to make a family provision claim if they were wholly or substantially maintained by the deceased or were dependants, depending on the circumstances. Creating a Will that explicitly names step-children as beneficiaries avoids this uncertainty entirely.

Property in your sole name (whether Brisbane inner-city, Gold Coast beachfront, or regional Queensland) becomes part of the intestate estate and must be distributed according to Queensland's statutory formulas. Property may need to be sold to allow the estate to be divided — meaning a family home might be sold even if your spouse and children still live there, because assets may need to be converted to cash for equal distribution, and the surviving spouse may not be entitled to receive the property outright under the intestacy formula. Joint property held as joint tenants bypasses intestacy entirely, but tenants in common ownership means your share goes through Queensland's distribution rules.

Yes — this is called bona vacantia. If the Queensland Supreme Court cannot identify any eligible relatives under the Succession Act 1981 (QLD) hierarchy, your entire estate passes to the Queensland government. This is rare but can happen for people with no surviving family or unclear family connections. Creating a Will ensures your estate goes to chosen beneficiaries (friends, charities, or organisations) even if they're not related to you.

Queensland intestacy is significantly more expensive. Letters of Administration may cost $2,500-$10,000+ in legal fees (often higher in regional Queensland), plus 4-9 months of frozen assets causing additional hardship. Probate with a Will typically costs $1,500-$3,000 and is usually significantly faster — often granted in 6-8 weeks after filing — whereas Letters of Administration often take several months longer. The total cost difference can be thousands of dollars plus months of financial hardship for your family.

Will Hero offers Queensland-compliant online Will creation that automatically follows Succession Act 1981 (QLD) requirements. Our platform guides you through every step, ensures proper Queensland witnessing requirements, and takes just 15 minutes. Learn more in our complete guide to making a Will in Queensland or get started with Online Wills Queensland.

How Will Hero Can Help Queenslanders

Protecting your loved ones with a legally valid Will doesn’t have to be complicated or expensive. Will Hero makes the process straightforward for Queensland residents in Brisbane, Gold Coast, Cairns, Townsville, and everywhere in between:

- Queensland-Specific Compliance: Our platform automatically follows all requirements under the Succession Act 1981 (QLD), ensuring your Will is legally valid in Queensland

- Step-by-Step Visual Guidance: Our Visual Will and Scenario Testing features provide an intuitive interface that guides you through every section, helping you understand how your estate will be distributed

- More than just a Simple Will: Customise your Will with detailed provisions and clauses to match your unique circumstances

- AI Assistant: Will Hero’s AI Assistant WillBot is available around the clock to help with questions about Wills, estate planning, and Queensland law

- Expert Support: Get assistance with drafting your Will and using our platform. We provide clear Queensland-specific signing and witnessing instructions to guide you through the process

- Easy Updates: Update your Will whenever your situation changes — new relationships, children, property acquisitions, or other life events

- Cost-Effective: Will Hero offers professional-quality Will creation for $99 (partner discount available at $59 for second Will, save $40) — see our pricing for details — at a fraction of traditional Brisbane or Gold Coast solicitor fees

Will Hero helps Queenslanders create a Will that meets all legal requirements without the high costs or scheduling constraints of traditional legal services.