- Estate Planning

- Partners

What Happens if I Get Married After Making My Will? (2026 Guide)

Getting married after making your Will? In most Australian states, marriage automatically revokes your existing Will. Learn what happens, state-by-state rules, and how to protect yourself.

Quick Answer

Marriage automatically revokes your entire Will in Australia unless your Will was made in contemplation of that specific marriage.

This means if you get married after creating your Will, your existing Will becomes completely invalid, and you will usually die intestate (without a Will) unless you create a new Will after marriage.

What to do: Create a new Will after marriage to ensure your wishes are legally binding. Create or update your Will online with state-compliant templates to ensure your Will reflects your current relationship status and protects your spouse’s inheritance rights. With Will Hero’s 12-month subscription, you can update your Will at no extra cost if your marital status changes.

Understanding How Marriage Affects Your Will

Getting married is one of life’s most significant milestones — but many Australians don’t realise that marriage can completely invalidate their existing Will. This legal rule exists across all Australian states and territories, and it can have serious consequences if you die without updating your Will after marriage.

If you’re getting married soon or have just married: update your Will as soon as possible. With Will Hero, your purchase includes 12 months of free updates, so you can create or update your Will before the wedding and revise it after at no extra cost — create or update your Will here.

What Happens When Your Will Is Revoked

When marriage revokes your Will, your entire Will becomes invalid — not just parts of it. This means:

- Your carefully planned estate distribution becomes invalid

- Your chosen executors and guardians are no longer appointed

- Your specific gifts and bequests are cancelled

- Your estate falls under intestacy laws, which may not reflect your wishes

Important distinction: This is different from the effect of divorce on a Will in Queensland, which only revokes parts of your Will relating to your ex-spouse (gifts and executor appointments), while the rest of your Will remains valid.

Why This Matters

This is one of the most common ways people accidentally lose control over their estate. If you die after marriage without updating your Will (and your Will wasn’t made in contemplation of marriage), your estate is distributed according to your state’s intestacy laws. While your spouse will typically inherit, the distribution may not match what you intended for other beneficiaries, such as:

- Children from previous relationships

- Step-children you’ve raised

- Other family members or friends

- Charities or organisations you wanted to support

Example: Emma creates a Will in 2024 leaving her estate to her adult children from a previous relationship. She gets married in 2025 but doesn’t update her Will. If Emma dies in 2026, her Will from 2024 is completely invalid. Her estate will be distributed according to intestacy laws, which may give most of her estate to her spouse rather than her children, despite her original intentions.

State-by-State Rules: How Marriage Revokes Your Will

As at 2026, this rule applies across all Australian states and territories. In Australia, marriage revokes your Will by default unless you take steps to prevent it. While the general principle is similar across Australia, each state has its own legislation governing how marriage affects Wills. Here’s what you need to know in each state:

New South Wales (NSW)

Succession Act 2006 (NSW)

Rule: Marriage automatically revokes your entire Will unless it was made in contemplation of that marriage.

What this means:

- If you get married after creating your Will, your existing Will is automatically revoked and becomes invalid in its entirety

- The entire Will is revoked — not just parts of it — meaning all estate distribution, executor appointments, and guardian appointments become invalid

- The only exception is if your Will explicitly states it was made in contemplation of that specific marriage

- You need to create a new Will after marriage to ensure your wishes are legally binding

Example: Lisa creates a Will in 2024 naming her sister as executor and leaving her estate to her children from a previous relationship. She gets married in 2025 but doesn’t update her Will. If Lisa dies in 2026, her Will from 2024 is invalid. Her estate will be distributed according to NSW intestacy laws, which may not reflect her original wishes for her children.

Learn more: Create your online Will in NSW or read our NSW will requirements guide. For the full legislation, see the Succession Act 2006 (NSW).

Victoria, Queensland and Western Australia

Wills Act 1997 (VIC), Succession Act 1981 (QLD), Wills Act 1970 (WA)

Rule: Marriage automatically revokes your entire Will unless it was made in contemplation of that marriage.

What this means:

- If you get married after creating your Will, your existing Will is automatically revoked and becomes invalid in its entirety

- The entire Will is revoked — not just parts of it — meaning all estate distribution, executor appointments, and guardian appointments become invalid

- The only exception is if your Will explicitly states it was made in contemplation of that specific marriage

- You need to create a new Will after marriage to ensure your wishes are legally binding

Example: Michael creates a Will in Melbourne in 2024, leaving his estate to his parents and siblings. He gets married in 2025 but forgets to update his Will. If Michael dies in 2026, his Will from 2024 is invalid. His estate will be distributed according to Victoria intestacy laws, with his spouse inheriting, which may not match his original intentions.

Learn more: Create your online Will in Victoria, Queensland, or Western Australia, or read our guides for Victoria, Queensland, or Western Australia.

South Australia (SA)

Succession Act 2023 (SA)

Rule: Marriage automatically revokes a Will unless it was made in contemplation of that marriage.

What this means:

- If you get married after creating your Will, your existing Will is automatically revoked

- The only exception is if your Will explicitly states it was made in contemplation of that specific marriage

- You need to create a new Will after marriage to ensure your wishes are legally binding

Example: James creates a Will in Adelaide in 2024, leaving his estate to his siblings. He gets married in 2025 but doesn’t update his Will. If James dies in 2026, his Will from 2024 is invalid. His estate will be distributed according to South Australia intestacy laws, with his spouse inheriting, which may not match his original intentions.

Learn more: Create your online Will in South Australia or read our South Australia will requirements guide.

Australian Capital Territory, Northern Territory and Tasmania

Wills Act 1968 (ACT), Wills Act 2000 (NT), Wills Act 2008 (TAS)

Rule: The same general revocation rule applies — marriage automatically revokes your entire Will unless it was made in contemplation of that marriage.

What this means:

- If you get married after creating your Will, your existing Will is automatically revoked and becomes invalid in its entirety

- The entire Will is revoked — not just parts of it — meaning all estate distribution, executor appointments, and guardian appointments become invalid

- The only exception is if your Will explicitly states it was made in contemplation of that specific marriage

- You need to create a new Will after marriage to ensure your wishes are legally binding

Learn more: Create your online Will in the ACT or read our guides for ACT, Northern Territory, or Tasmania.

What Is “Contemplation of Marriage”?

A Will made “in contemplation of marriage” is one that explicitly states it was made in anticipation of a specific upcoming marriage. This prevents the Will from being automatically revoked when you marry that specific person.

Key requirements:

- The Will must clearly identify the intended spouse by name or relationship

- The Will must explicitly state it was made in contemplation of that specific marriage

- The marriage must be to the person identified in the Will

Important: Even if your Will was made in contemplation of marriage, it’s best practice to create a fresh Will after marriage that reflects your new marital status and any changes to your circumstances, assets, or beneficiaries.

Example: “This Will is made in contemplation of my marriage to [Spouse’s Name] on [Date].” This clause would prevent the Will from being revoked when you marry that specific person.

What Happens to Your Assets If You Die After Marriage Without Updating Your Will?

If you die after marriage without updating your Will (and your Will wasn’t made in contemplation of marriage), you will usually die intestate. Your estate will be distributed according to your state’s intestacy laws, which may not reflect your wishes.

Note: Superannuation and life insurance held within super funds are generally not governed by your Will and are distributed under separate nomination rules. Even if your Will is revoked by marriage, your binding death benefit nomination (if you have one and it is still current under your fund’s rules) with your super fund remains valid and will determine who receives your superannuation benefits. Learn more about what happens to your superannuation when you die.

Typical Intestacy Distribution

While exact rules vary by state, typical intestacy distribution when you die with a spouse but no Will includes:

Spouse only (no children):

- Your spouse inherits the entire estate

Spouse and children (all from that relationship):

- Your spouse inherits the entire estate

- Your children may not receive anything directly under intestacy laws (though they may be eligible to make family provision claims)

Spouse and children (some from previous relationship):

- Your spouse receives a statutory legacy amount (typically around $400,000-$500,000, indexed and varies by state) plus interest, plus 50% of the remainder

- Your children receive 50% of the remainder, divided equally

What this means: If you had specific wishes for your estate — such as leaving certain assets to children from a previous relationship, step-children, or other beneficiaries — these wishes won’t be honoured. Your estate will be distributed according to strict statutory formulas that may not match your intentions.

Learn more: What happens if you die without a Will in Australia.

How to Protect Yourself: Updating Your Will After Marriage

The best way to protect yourself and your loved ones is to create a new Will after marriage that reflects your current wishes and circumstances.

When to Update Your Will

Immediately after marriage: You should create a new Will as soon as possible after getting married, ideally within weeks rather than months. While there’s no legal deadline, delaying leaves your estate unprotected.

What to include in your new Will:

- Your spouse as a beneficiary (if desired)

- Any children from your marriage or previous relationships

- Step-children (if you want them included)

- Updated executor appointments

- Updated guardian appointments (if you have minor children)

- Any specific gifts or bequests you want to make

- Backup beneficiaries in case your primary beneficiaries predecease you

Using Will Hero to Update Your Will

With Will Hero’s 12-month subscription, you can update your Will at no extra cost if your marital status changes. Simply:

- Log in to your account

- Make the necessary changes to reflect your new marital status

- Update beneficiaries, executors, and any other provisions

- Download and re-sign your updated Will according to your state’s witnessing requirements

Learn more: How to make a legally valid Will in Australia.

Other Life Events That Affect Your Will

Marriage isn’t the only life event that should trigger a Will update. You should also review and update your Will after:

- Divorce or separation: Divorce affects your Will in specific ways — it typically revokes gifts to your ex-spouse and removes them as executor, but your Will otherwise remains valid

- Birth or adoption of children: You may want to add new beneficiaries or update guardian appointments

- Death of a beneficiary or executor: You’ll need to update your Will to reflect these changes

- Significant changes in assets: Acquiring or selling major assets may change how you want your estate distributed

- Moving to another state: While your Will remains valid, different states have varying requirements, so it’s good practice to review and potentially update

Learn more: Common mistakes to avoid when creating your Will.

How Will Hero Can Help

Protecting your loved ones with a legally valid Will doesn’t have to be complicated or expensive. Will Hero makes the process straightforward for Australians across all states:

- State-Specific Compliance: Our platform automatically follows all requirements under your state’s legislation, ensuring your Will is legally valid

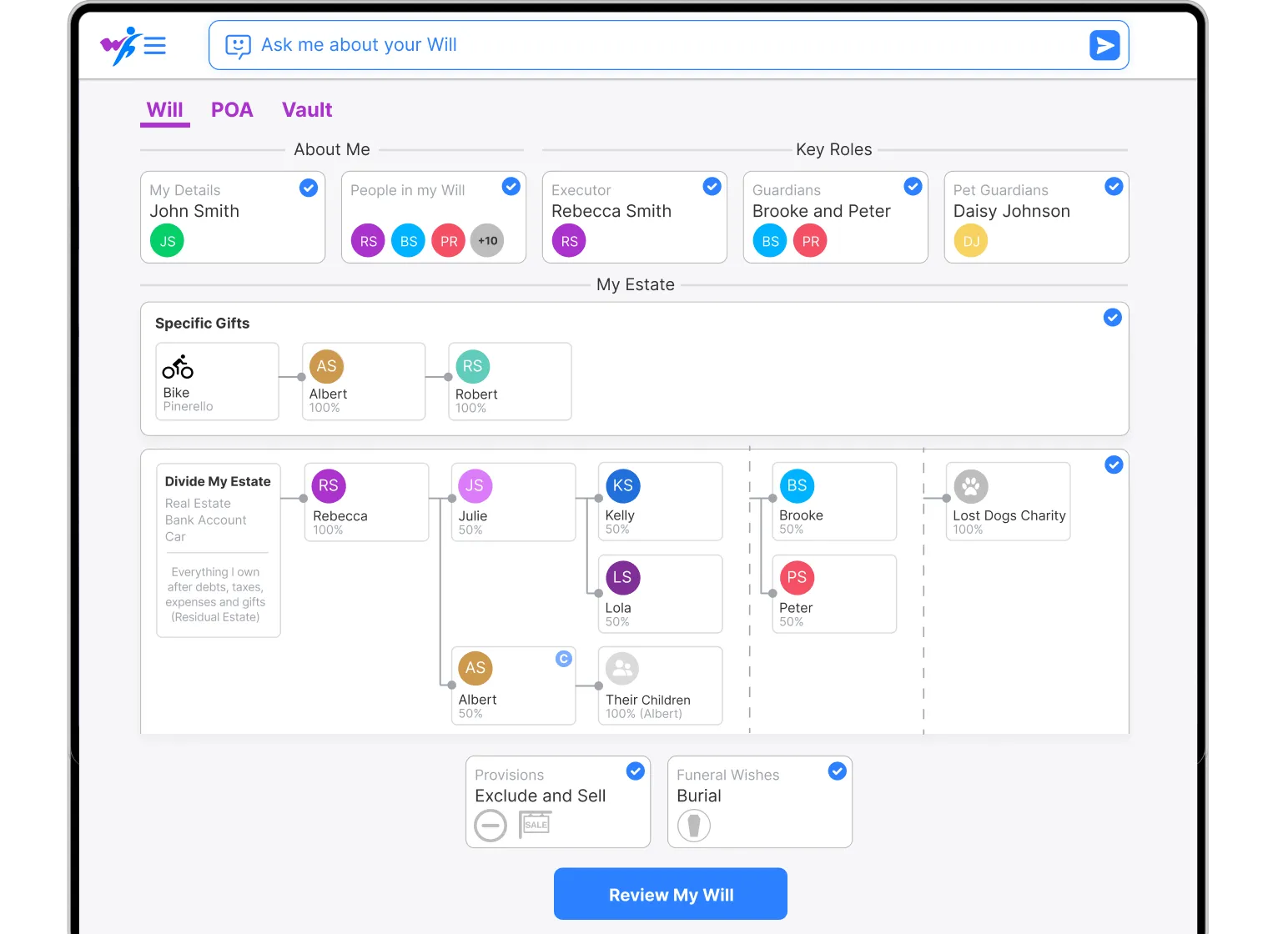

- Step-by-Step Visual Guidance: Our Visual Will and Scenario Testing features provide an intuitive interface that guides you through every section

- More than just a Simple Will: Customise your Will with detailed provisions and clauses to match your unique circumstances

- AI Assistant: Will Hero’s AI Assistant WillBot is available around the clock to help with questions about Wills, estate planning, and state law

- Easy Updates: Update your Will whenever your situation changes — marriage, divorce, birth of children, or other life events — with our 12-month subscription

- Cost-Effective: Will Hero offers professional-quality Will creation for $99 (partner discount available at $59 for second Will, save $40) — see our pricing for details — at a fraction of traditional solicitor fees

Will Hero helps Australians create a Will that meets all legal requirements without the high costs or scheduling constraints of traditional legal services.

Protect Your Family After Marriage

No credit card required to start

Please note: Wills created in Australia must meet the formal requirements set out in their respective state or territory. Most notably, all documents must be in writing, signed, and witnessed by two independent witnesses. This article provides general information only and does not constitute legal advice. For specific legal advice about your situation, please consult with a qualified legal professional.

Frequently Asked Questions

Yes, in most Australian states and territories, marriage automatically revokes your entire Will unless the Will was made in contemplation of that specific marriage. The same general revocation rule also applies in the ACT, Northern Territory and Tasmania, although the governing legislation differs. This means if you get married after creating your Will, your existing Will is automatically revoked and becomes invalid in its entirety. You will usually die intestate (without a Will) unless you create a new Will after marriage or your Will was made in contemplation of that marriage. This is different from divorce, which only revokes parts of your Will relating to your ex-spouse, while the rest of your Will remains valid.

A Will made 'in contemplation of marriage' is one that explicitly states it was made in anticipation of a specific upcoming marriage. This prevents the Will from being automatically revoked when you marry that specific person. The Will must clearly identify the intended spouse by name or relationship.

Yes, you should create a new Will after getting married to ensure your wishes are legally binding. Even if your Will was made in contemplation of marriage, it's best practice to create a fresh Will that reflects your new marital status and any changes to your circumstances, assets, or beneficiaries.

If you die after marriage without updating your Will (and your Will wasn't made in contemplation of marriage), you will usually die intestate. Your estate will be distributed according to your state's intestacy laws, which may not reflect your wishes. Your spouse will typically inherit, but the distribution may not match what you intended for other beneficiaries.

Yes. In NSW, marriage automatically revokes a Will unless it was made in contemplation of that marriage. Under the Succession Act 2006 (NSW), if you get married after creating your Will, your existing Will is automatically revoked and becomes invalid. You need to create a new Will after marriage to ensure your wishes are legally binding.

Yes. In Victoria, marriage automatically revokes a Will unless it was made in contemplation of that marriage. Under the Wills Act 1997 (VIC), if you get married after creating your Will, your existing Will is automatically revoked. You should create a new Will after marriage to ensure your wishes are legally binding.

Yes. In Queensland, marriage automatically revokes a Will unless it was made in contemplation of that marriage. Under the Succession Act 1981 (QLD), if you get married after creating your Will, your existing Will is automatically revoked. You need to create a new Will after marriage to ensure your wishes are legally binding.

Yes. In Western Australia, marriage automatically revokes a Will unless it was made in contemplation of that marriage. Under the Wills Act 1970 (WA), if you get married after creating your Will, your existing Will is automatically revoked. You should create a new Will after marriage to ensure your wishes are legally binding.

Yes. In South Australia, marriage automatically revokes a Will unless it was made in contemplation of that marriage. Under the Succession Act 2023 (SA), if you get married after creating your Will, your existing Will is automatically revoked. You need to create a new Will after marriage to ensure your wishes are legally binding.

You should update your Will as soon as possible after marriage, ideally within weeks rather than months. While there's no legal deadline, delaying leaves your estate unprotected. If you die before updating your Will (and it wasn't made in contemplation of marriage), you will usually die intestate and your assets are distributed according to state law, not your wishes.

About Will Hero

Will Hero is an Australian online Will platform that provides state-specific Will templates designed around Australian succession law. Documents are created using guided software and reviewed against jurisdiction requirements used across the platform. Thousands of Australians have used Will Hero to prepare their Will online.

Will Hero provides general legal information and document preparation tools and is not a law firm or a provider of personalised legal advice. The platform is intended for use by Australian residents making a Will under Australian state law.